🔥 This offer expires in:

🔥 This offer expires in:

For Everyday People Who’ve Tried Budgeting And Given Up (Again)

64% Quit Budgeting Because It's Too Much Work - This 10 Minute System Fixes That For Good

Without tracking every expense, cutting all your “fun money,” or needing to be good with numbers. This stress-free PDF gives you a proven way to stay on budget, handle surprise bills, and finally feel confident with your money - for real this time.

4.8 / 5

Rated by real readers. Loved for real results

KYLE DAWSON

SALES REP & DAD OF 2

I used to just wing it. Money in the bank, random investing apps, and hoping for the best. I didn’t realize how much money I was leaking without even noticing. This guide connected all the dots. I’ve already made one small change that saved me way more than the cost of the guide. Total game changer.

INTRODUCING BUDGET LIKE A PRO

57% Of Americans Can't Afford a $1000 Emergency - Budget Like A Pro Helps You Break The Cycle Before It Breaks You

What Happens When Life Hits You With a Bill You Didn’t See Coming?

A flat tire. A medical co-pay. A surprise vet visit. According to Bankrate, 57% of Americans can’t cover a $1,000 emergency from savings - and for many, that one unexpected expense sends everything spiraling.

If that sounds familiar, you’re not alone.

Most people want to save. They try to budget. But between rising costs, inconsistent income, and the mental drain of tracking every dollar, it’s easy to fall behind - fast.

That’s exactly why Budget Like a Pro was created.

It’s not a spreadsheet. It’s not another budgeting “hack.”

It’s a real-life budgeting system that helps you stay in control, plan ahead for surprise expenses, and finally stop feeling like money is slipping through your fingers. No guilt. No overwhelm. Just a simple, doable way to start building the financial stability you’ve been craving.

Ditch Debt Without Feeling Deprived

The average U.S. household pays 21.5% APR on credit cards, draining your paycheck before it even lands. This guide helps you knock out high-interest debt fast - without cutting everything you enjoy or giving up your social life.

No More “Where Did My Money Go?” Moments

Nearly 60% of people earning over $100K still live paycheck to paycheck. It’s not about income - it’s about control. Our system shows you how to give every dollar a job, so your money stops vanishing days after payday.

Designed for Real Life, Not Complicated Spreadsheets

Rigid budgets fail because life’s unpredictable. In fact, 53% of budgeters quit within 6 months. This method adapts to you, giving you breathing room for fun, flexibility for surprises, and structure that actually sticks.

End the Panic When Life Hits You With a Bill

A $400 car repair shouldn’t feel like a crisis - yet 40% of Americans can’t cover that without borrowing. This guide helps you build a real emergency buffer so you can stop living in financial fight-or-flight mode.

MORE THAN JUST A PDF

Take Control of Your Cash.

Without Guilt, Guesswork, or Giving Up Your Life...

Right after your purchase, you'll receive 6 core sections built to help you create a budget that works in real life!

A New Way To Think Abour Money (That Actually Feels Good)

Here's what you'll discover:

Why most people who “fail” at budgeting are making the same invisible mistake - and how to spot it before it trips you up again (pg.4)

A surprising reason you avoid checking your bank account (it’s not laziness, and it’s not your fault)

How your earliest money experiences might be quietly wrecking your budget - and how to rewrite the story starting now (pg. 6)

The mindset shift that makes budgeting feel empowering instead of exhausting

The Simple System That Works When Everything Else Has Failed

Here's what you'll discover:

The real reason you keep falling off the budgeting wagon - and the small shift that makes it easier to stay on track (pg. 8)

How to divide your money into three buckets that make spending clear, simple, and stress-free

The built-in structure that helps you avoid burnout without cutting out everything fun (pg. 12)

Why this method feels like freedom, not restriction - and how it changes your entire relationship with money

How to Stick to Your Budget (Even When Life Happens)

Here's what you'll discover:

The hidden reason most people abandon their budget by month two - and how to make sure that’s not your story (pg. 24)

Why going over budget doesn’t mean you “failed” (and the simple shift that keeps you moving forward)

A flexible approach that adjusts with your life (pg. 26), so one bad week doesn’t wipe out all your progress

How to spend on what you love - and still make serious progress toward your financial goals

What to Do Before Life Throws You a Financial Curveball

Here's what you'll discover:

Why most people aren’t prepared for emergencies - and how a two-tier safety system keeps you calm when life happens (pg. 30)

The difference between a crisis and an “oh $#!t” moment - and how having the right fund for each keeps your budget intact

How to calculate exactly how much you need to feel secure no matter what comes your way

The sneaky reason most emergency funds don’t work - and how to build one that has your back when you need it

How to Budget When Your Paycheck Keeps Changing

Here's what you'll discover:

Why traditional budgets don’t work when your income’s all over the place - and the smarter system to use instead (pg. 35)

The monthly baseline strategy: How to set a solid spending plan even when you’re not sure what’s coming in

What to do in high-income months so you’re not stressed in the slow ones (hint: most people do the opposite)

A confidence-boosting method that finally helps you feel stable - even when your paychecks aren’t

The Conversation That Ends Money Fights For Good

Here's what you'll discover:

The #1 reason money causes tension in relationships and how to stop the blame game for good (pg. 39)

How to handle totally different spending styles without turning every conversation into a debate

The simple system to set joint goals, split expenses fairly, and build trust with every paycheck

A 10-minute check-in ritual that keeps your finances (and your relationship) from silently falling apart

GET OUR REAL-LIFE BUDGETING SYSTEM (VALUED AT $197) BEFORE YOUR NEXT EMERGENCY HITS - FOR JUST $17!

4.8 / 5

Rated by real readers. Loved for real results

Exclusive Bonuses Just For YOU!

Along with the guide, get 2 special bonuses that fast-track your financial wins. These extras are designed to support your journey and help you build momentum faster. Act now to unlock both instantly!

Bonus 1: THE CREDIT CARD RESET

The step-by-step strategy to stop spinning your wheels with debt - and finally make real progress toward paying it off.

This isn’t just about interest rates and payoff plans (though we cover that too). It’s about taking back control, breaking the cycle of minimum payments, and clearing the mental weight that credit card debt quietly piles on.

BONUS 2: THE EMERGENCY FUND JUMPSTART TOOLKIT

A 4-week action plan to build your first real safety net—without cutting out everything fun or feeling overwhelmed.

Perfect for anyone who panics when life throws a bill they didn’t expect. This toolkit shows you exactly how to start saving, where to find hidden cash fast, and how to finally feel safe, not scared, when surprises hit.

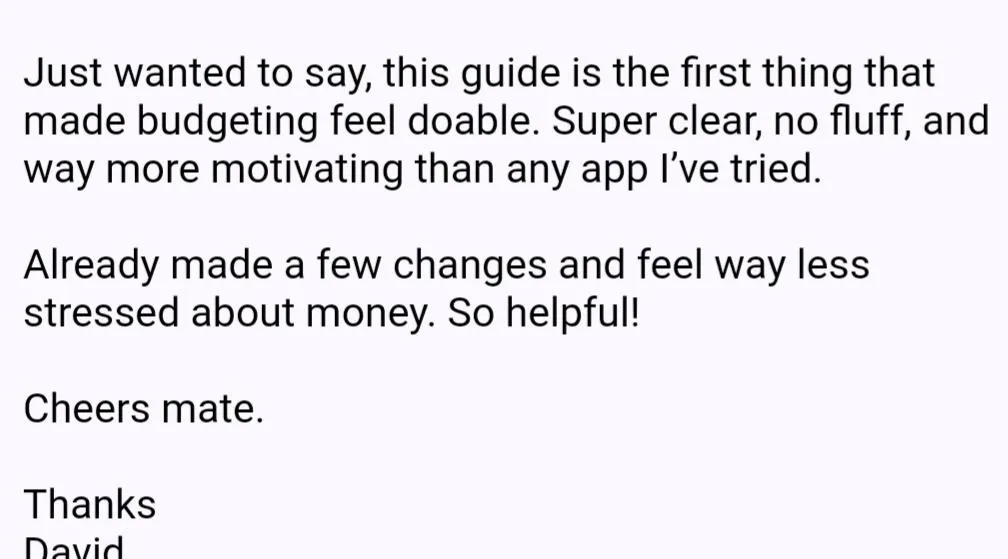

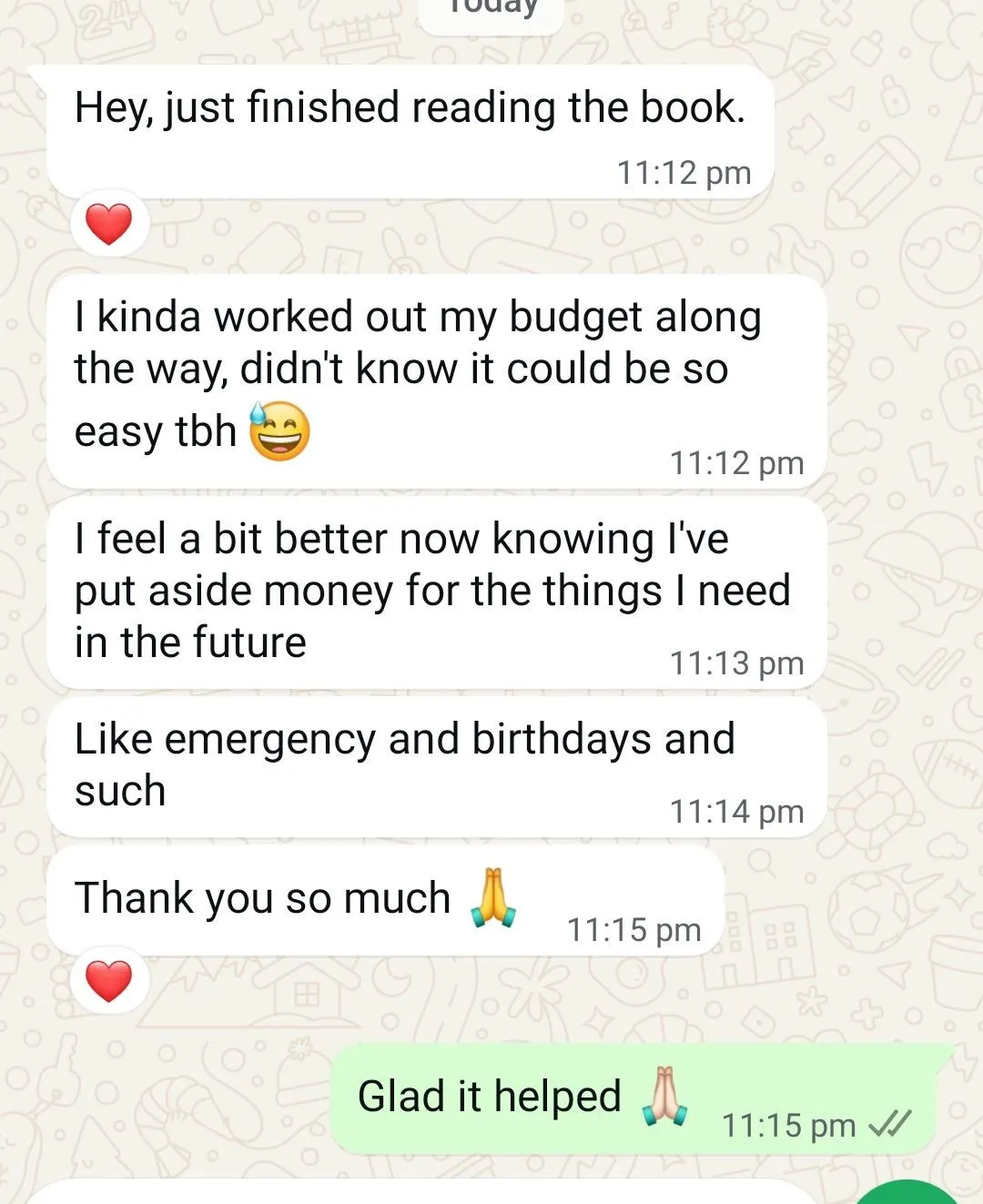

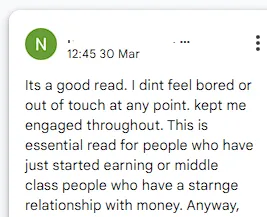

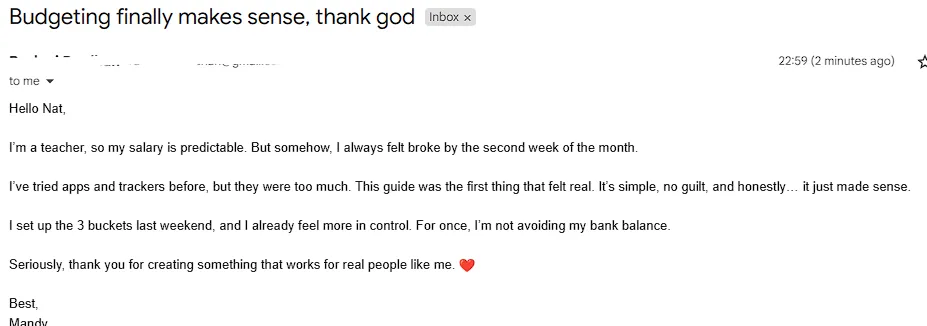

REAL SUCCESS, REAL PEOPLE

Join Our Community of Success Stories

4.8 / 5

Rated by real readers. Loved for real results

READY TO GET STARTED?

Get The Budget Like A Pro PDF Today!

With this guide, you gain immediate access to practical tools that help you take control of your money and stop living paycheck to paycheck. For a limited time, grab this complete budgeting package, plus both powerful bonuses, for just $17. Don’t miss your chance to transform your finances and start managing money like the top 1%.

BUDGET LIKE A PRO PDF

$17 USD

VAT/Tax Include

4.8 / 5

Rated by real readers. Loved for real results.

Full 56 Page Budget Like A Pro PDF

BONUS 1: The Credit Card Reset

A step-by-step strategy to help you break free from debt and finally make real progress towards building wealth - without feeling overwhelmed.

BONUS 2: Emergency Fund Jumpstart Toolkit

A 4-week action plan to start building your financial safety net, so surprise bills don’t send you into panic mode.

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

Budget Like a Pro shows you why most budgets fail and gives you a simple, real-life system that actually works. You’ll learn how to organize your money, plan for surprise expenses, and finally stick to a budget without tracking every dollar or cutting all your fun. Best part? You can start using it today - no apps, no spreadsheets, no overwhelm.

Is this guide suitable for beginners?

Absolutely. This guide was made for everyday people who are tired of feeling behind with money. Whether you’ve tried budgeting before or you’re starting from scratch, everything is explained in simple, clear language - no jargon, no spreadsheets. Just real steps you can follow, even if numbers aren’t your thing.

How much time will this take to implement?

You can start seeing results in under an hour. Most people go through the guide and start applying the system the same day. You’ll make progress at your own pace but the first steps are fast, simple, and immediately helpful.

Will this help me if I’ve already tried budgeting before?

Yes! Especially if you’ve tried and given up. Budget Like a Pro was created for people who’ve struggled with rigid budgets, complicated apps, or tracking fatigue. This guide gives you a flexible, stress-free system that works with real life. Not against it. If other methods didn’t stick, this one’s for you.

What resources come with the guide?

Along with the main Budget Like a Pro system, you’ll get two powerful bonuses: The Credit Card Reset to help you tackle debt fast, and The Emergency Fund Jumpstart Toolkit - a 4-week plan to start building real savings. Everything is designed to help you take action quickly and feel in control of your money from day one.

How is this different from free advice I can find online?

Great question. Instead of piecing together random tips from blogs and TikToks, Budget Like a Pro gives you one clear, proven system - built for real life. No fluff, no guesswork. Just a step-by-step plan that’s easy to follow and actually stick with, all in one place.

Do I need any special tools, apps, or spreadsheets?

Nope. Budget Like a Pro is designed to be simple and flexible. You don’t need any fancy apps or complicated spreadsheets. Just use whatever you’re most comfortable with. Pen and paper works great, but if you love spreadsheets, the system works perfectly with that too.

Is there a guarantee if I’m not satisfied?

Because this is a digital product, all sales are final. That said, we’ve packed Budget Like a Pro with real-world strategies that many users say paid for themselves within days. If you follow the steps, we’re confident you’ll get way more than $17 worth of clarity, control, and peace of mind.

4.8 / 5

Rated by real readers. Loved for real results

All rights reserved 2025

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.